Farmers in Brazil are expected to plant more soybeans and less corn in the 2023-2024 crop season, according to the National Supply Company (Conab), the country’s food supply and statistics agency. The reason? Producers find corn prices unattractive relative to soybeans. In addition, the El Niño weather pattern has adversely affected the outlook for corn in Brazil. This article focuses on the first official government estimates for soybean and corn acreage, production in the new crop season, and planting rate to date. In addition, we discuss the latest balance sheets on supply and demand estimates for corn and soybeans that bear watching.

El Niño Weather Pattern Could Affect Yields

Three consecutive growing seasons under La Niña influence generated severe droughts for Argentina and Brazilian southern states (see farmdoc daily, March 31, 2023). However, this crop season will be very different. El Niño has developed in the tropical Pacific Ocean, and its weather pattern is already affecting Brazil’s grain outlook. In Rio Grande do Sul, Brazil’s southernmost state, heavy rains have considerably delayed the first corn planting in September.

El Niño is a climate pattern characterized by unusual warming of surface waters in the eastern tropical Pacific Ocean. El Niño is the “warm phase” of the larger phenomenon El Niño-Southern Oscillation (ENSO). La Niña, the “cool phase” of ENSO, is a pattern that describes the unusual cooling of the region’s surface waters. Generally speaking, the effects of El Niño are the opposite from La Niña for South America.

During the growing season under El Niño influence, northern Brazil usually sees below-normal rainfall, which can also bleed into portions of central Brazil, the main agricultural region. Temperatures also are generally higher, increasing the risk for crops. However, the weather pattern across Argentina and southern Brazil is more active, and rainfall amounts trend above average for the spring and summer (Baranick, 2023).

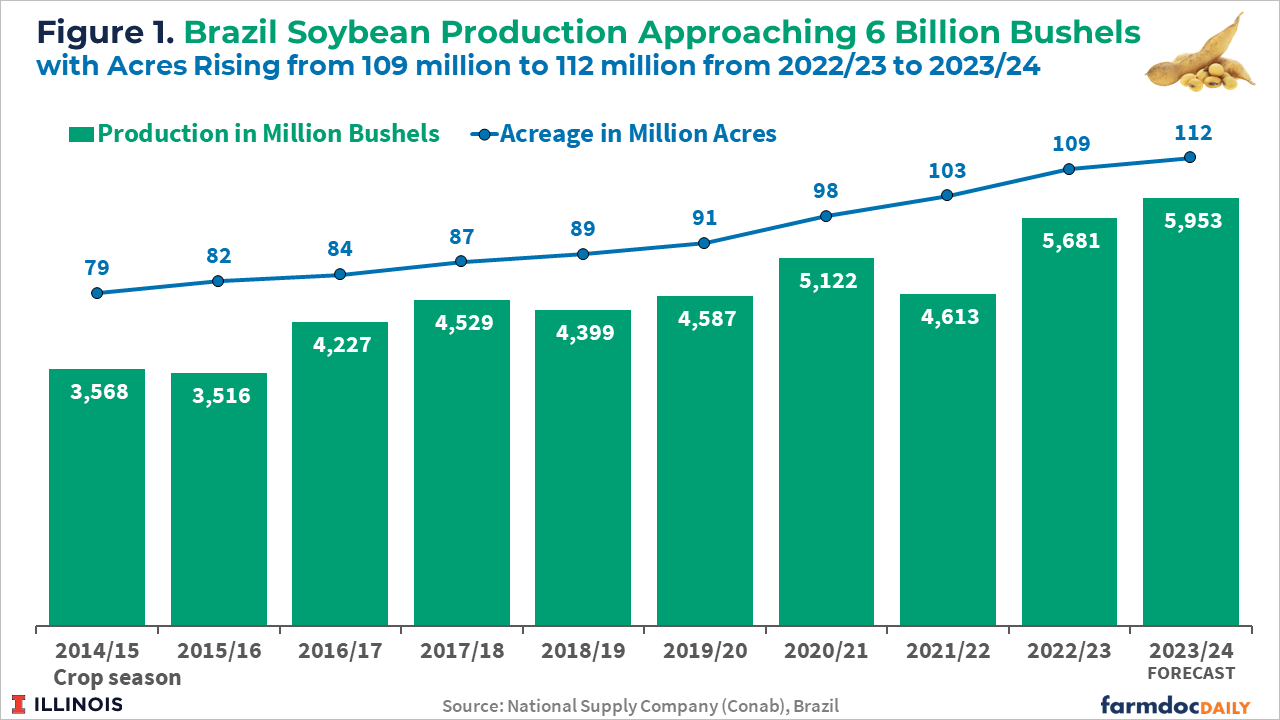

Record Year Forecasted for Soybean Area and Production

The 2023/2024 soybean crop is projected to be a record 5,953 million bushels, an increase of 4.8% over the previous harvest. Brazilian soybean acreage is expected to grow 2.5% to 112 million acres, according to Conab (see Figure 1). The largest expansion in percentage terms will be in Brazil’s North and Northeast regions, with some expansion coming from the conversion of pasture to crop land while some of the expansion comes at the expense of other crops.

Brazil’s soybean prices are at their lowest levels since before the pandemic, yet farmers continue expanding their growing areas. Farmers switching to growing soybeans instead of corn in the first season is the cause. Corn prices are at even lower levels relative to soybeans. Also, this is the first season in several years that the cost of soybean production in Brazil is expected to decrease. The driving factor is the decrease in the price of fertilizers (USDA, 2023).

Brazilian farmers started sowing their 2023/24 soybean crop in the western states around mid-September. As of October 14th, 19% of the final expected soybean crop had been planted in Brazil, just two percentage points less compared to the same period last year, according to data from Conab. In Mato Grosso, the leading grain-producing state, as of October 13th, farmers had planted 35% of their expected total soybean crop, according to the Mato Grosso Institute of Agricultural Economics (Imea).

Favorable Exchange Rate and Global Demand Fuel Exports

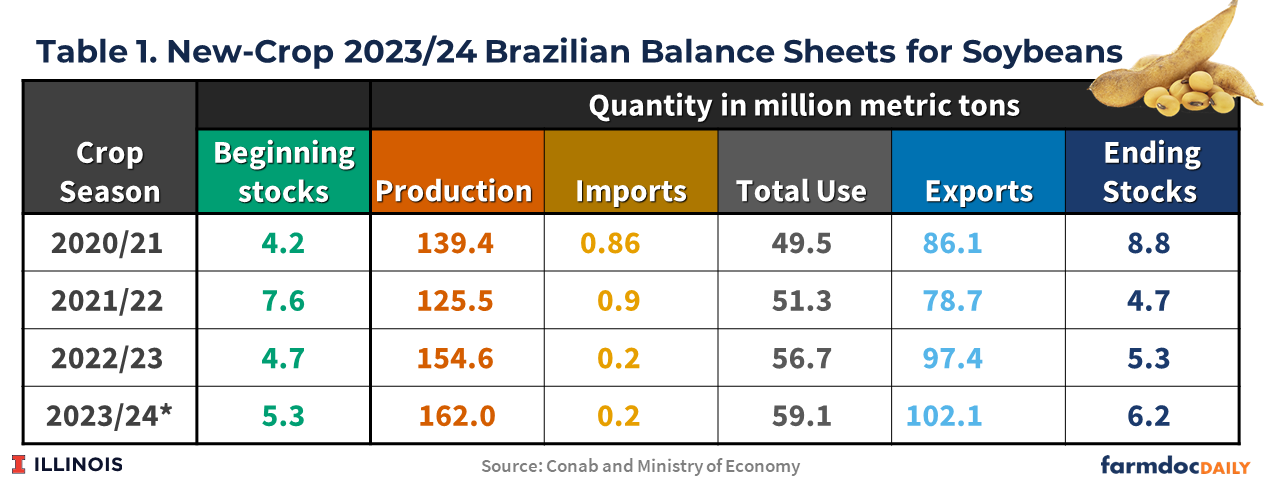

Table 1 shows the latest balance sheets for soybeans released by Conab on October 10th. Brazilian soybean exports in 2023/2024 are forecast at a record 102 million tons, a 5% increase from last season’s shipments of 97 million tons. The forecast is based on available supplies, favorable exchange rates, and continued robust global demand. Brazil’s Central Bank projects the nation’s domestic currency to trade at about or above Real $5 to the U.S. dollar into 2024. A weak Real means that Brazil’s agricultural commodities continue to be of great relative value in international markets.

The 2022/23 crop season has seen record soybean exports, with several months hitting monthly record highs. Brazil’s August and September soybean exports were records, nearly 50% better than a year ago. From February to August 2023, Brazil exported 80 million metric of soybeans compared to 64 million tons during the same period the previous year. This can be attributed to record production in Brazil, continued demand from China, and significantly lower soybean production in Argentina (see farmdoc daily, March 31, 2023)

Meanwhile, total domestic use of soybeans in Brazil is estimated to be 59.1 million tons, as a result of an increase in soybean oil for biodiesel production, since the Brazilian government has raised national biodiesel blending mandate to 13% from the existing 12% from April 2024. The crushing expansion is also based on the available soybean supply and rising demand for both soy oil and soy meal domestically.

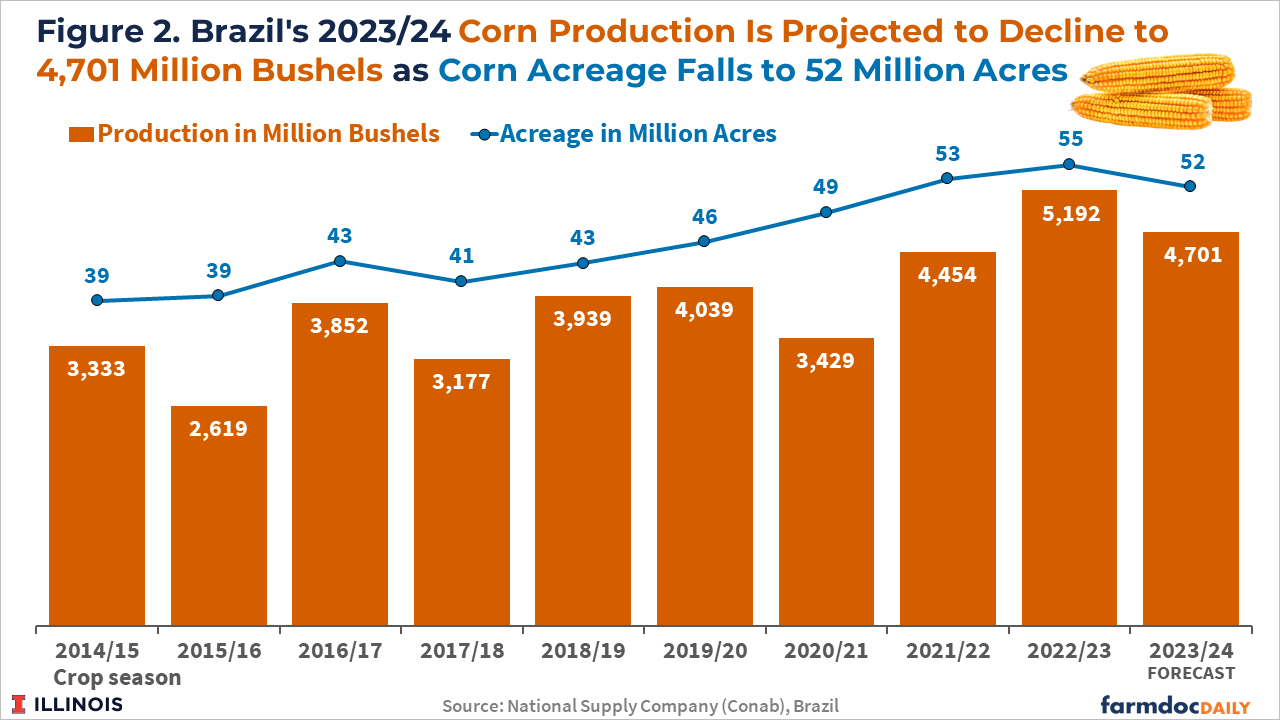

Corn Acreage and Production is Expected Smaller

Brazilian total corn acreage is expected to decrease by 5% to 52 million acres, according to Conab. The 2023/2024 corn crop is projected to be down to 4,701 million bushels, a 9.5% drop from last season, reflecting a smaller planted area and the initial effects of the El Niño weather pattern (see Figure 2). Brazilian farmers find soybean prices relatively more attractive than corn prices and the El Niño weather pattern as a factor limiting corn yields since the cereal is more sensitive to possible lack of rain in the Central-West States.

Brazil’s first and second crop corn planted area are expected to decline by 6.7% and 4.5%, respectively, in the 2023/24 cycle, according to the Conab forecast. Brazilian farmers have started sowing their 2023/24 first corn crop in September in the nation’s south. Brazil’s corn planting reached 30% of the planned area as of October 14th, the same pace as the previous year. More than 70% of the corn produced in Brazil is from the second corn crop (known as the safrinha), planted typically in January and February in the Center-West states.

Brazil Could Lose Its Top Corn Exporter Title in 2024

After overtaking the United States this year as the world’s top corn exporter, Brazil is expected to reduce its shipments in the 2023/24 marketing year. Brazilian corn exports are forecast at 38 million tons, a 27% decrease from the record shipments of 52 million tons in the 2022/23 marketing year. Table 2 shows the latest balance sheets for corn released by Conab on October 10.

The United States lost its position as the world’s No. 1 corn exporter to Brazil last year when Brazil harvested a record crop after China opened its market to Brazilian corn in November 2022. Consequently, in the first eight months of 2023, about 18% of Brazil’s corn exports went to China compared with none in previous years. Over that same period, just 13% of all American corn shipments were destined for China, compared with 26% a year earlier.

Although Chinese interest in U.S. corn has slowed significantly in the past year, the lower projection of the Brazilian harvest and the greater supply of corn in the United States will potentially allow plentiful U.S. supplies to regain a share in global trade. However, comparing trade forecasts can be tricky since local marketing years differ in the United States and Brazil. On an October-September basis, the U.S. Department of Agriculture projects 2023-24 Brazilian corn exports at 59 million tons versus 53.7 million in 2022/2023. U.S. shipments are estimated at 52.5 million tons in 2023/2024 versus 43 million in 2022/2023.

Conclusion

The first forecast for the 2023/2024 crop season from Conab projects that Brazilian farmers will expand their planted area to soybeans by 2.5% and reduce their planted area to corn by 4.8%. Corn acreage will be reduced as farmers find corn prices unattractive relative to soybeans. Also, the El Niño weather pattern already is affecting Brazil’s corn outlook. Brazilian soybean exports are forecast to hit record highs, based on available supplies, favorable exchange rates, and continued robust global demand. At the same time, Brazil is expected to reduce its corn shipments in the 2023/2024 marketing year after overtaking the United States this year as the world’s top corn exporter. If that happens, Brazil could return the corn export crown to the United States.

Colussi, J., N. Paulson, G. Schnitkey and J. Baltz. “Brazil Expected to Expand Soybean Acreage and Reduce Corn Acreage.” farmdoc daily (13):190, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 17, 2023.Permalink

Since February 2022, Russia’s war in Ukraine has caused significant damages to the country’s people, economy, and resource base. Russia has been targeting Ukraine’s agricultural sector, weakening one of its vital economic industries. Currently, Ukraine is the most heavily mined country in the world with almost a third of its territory being heavily contaminated with landmines, including 1.2 million acres of farmland (Hegglin, 2023). This article examines the impact of the war on Ukraine’s economy and people and Ukraine’s corn and wheat production and exports since the beginning of the conflict 19 months ago. The next article in this two-article set will explore the new export routes for Ukrainian grain since the Black Sea Grain Initiative expired following Russia’s exit in July 2023.

The Impact of the War on Ukraine’s Economy and People

Based on the most recent estimates, Ukraine’s military casualties have risen to 70,000 soldiers killed and over 100,000 injured (Cooper, 2023). The war is taking a significant toll on civilians as well: over 9,000 civilian deaths and 15,000 injuries are confirmed in the first 17 months of the war (the United Nations, 2023). About 6 million Ukrainians have fled the country seeking refuge from the war. Even though the return prospects look promising (about 63% of refugees plan to return to Ukraine), the permanent loss of the population due to the non-return from abroad has been estimated to result in a more than four percent decline of Gross Domestic Product (GDP) annually (Vyshlinsky et al, 2023).

The war has negatively impacted the overall economy as shown by a 30% decline in GDP in 2022. Total war damages to Ukraine’s agricultural sector amount to $40.2 billion including direct damages to machinery and equipment and indirect losses associated with lower production, logistics disruptions, and other factors (Kyiv School of Economics, 2023). Demining of the agricultural land alone will cost Ukraine about $1.5 billion (World Bank, 2023). However, as the Ukrainian people and businesses have started to adapt to the ongoing war, the economy grew three percent in the first quarter of 2023 and is projected to stay on this growth trajectory through the end of the year.

Ukraine’s Corn and Wheat Production and Exports

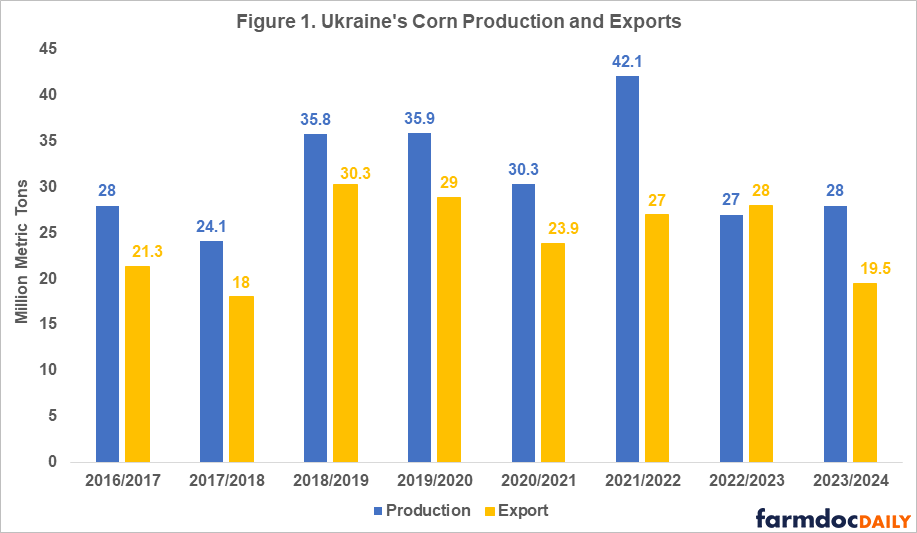

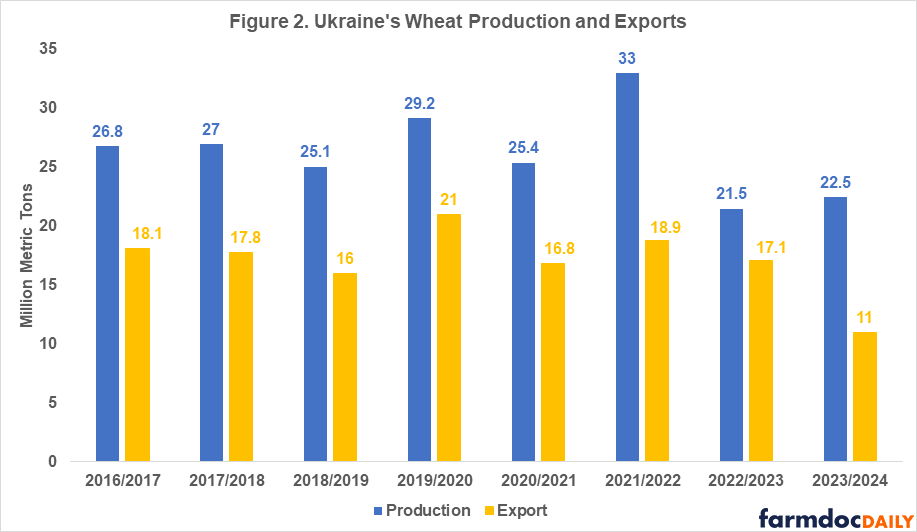

Ukraine is one of the main world exporters of grains as well as vegetable oils. The main agriculture export products are corn and wheat. In 2021, before the war, Ukraine was the second largest supplier of grains for the European Union and a large food supplier for low and middle-income countries in Asia and Africa. The war’s negative impacts on Ukraine’s agricultural production and exports in the last two years can be seen in Figures 1 and 2 and in Table 1.

In 2021, Ukraine had record wheat and corn yields resulting in 30-40% percent higher total production compared to 2020 levels (see Figures 1 and 2). While the 2021 harvest itself was unaffected by the war, exports of that year’s harvested grain were severely impacted in the second half of the 2021/2022 marketing year (February – July). Once Russia invaded Ukraine, export routes were disturbed due to the blockade of the Black Sea ports[1] which Ukraine used to export 90% of its grain prior to the war.

Note: values for 2023/2024 marketing year are projected values.

The new more expensive and slower export routes (by railway and truck) slowed down Ukraine’s grain exports in the second half of the 2021/2022 marketing year (see farmdoc daily, February 24, 2023). Slower exports coupled with record high production that year resulted in significantly higher ending stocks of wheat and corn than usual (5.27 million metric tons of wheat and 7.59 million metric tons of corn compared to the pre-war levels of 1.5 million metric tons). Even though the overall export levels were comparable in magnitude to pre-war levels, Ukraine was not able to export the extra grain harvested during that year.

In 2022, due to a 28% decline in planted area (11.1 million acres) compared to the pre-war levels and a 12-16% decline in yields of corn and wheat, Ukraine’s production dropped to 27 million tons of corn and 21.5 million tons of wheat – a 34-35% decline compared to 2021 levels (USDA FAS, 2023; USDA WASDE, 2023). However, given that the 2021 production year was an outlier characterized with extremely high yields, an accurate comparison of the changes in production and exports before and after the invasion must be done with the average levels over multiple years prior to the beginning of the war (see Table 1).

Note: values for 2023/2024 marketing year are projected values.

The Black Sea Grain Initiative (BSGI) was an agreement between Ukraine, Russia, Turkey, and the United Nations to remove the blockade of the Black Sea and resume maritime grain shipments from the Ukrainian Black Sea ports. Ukraine exported 40% of its 58 million metric tons of total grain exports in 2022/2023 through the BSGI. The agreement was put in place in July 2022. A year later, Russia pulled out of the agreement and announced that it would treat all vessels as military targets in the Black Sea region further deteriorating grain export routes for Ukrainian farmers.

Table 1 shows the percentage change in production and exports for corn and wheat in the last three years compared to the five-year average capturing the 2017-2021 production years. Ukraine’s corn and wheat production in 2022 declined by 20–23% compared to pre-war levels. Despite very pessimistic projections after the invasion, Ukrainian grain exports have turned out much stronger than expected.

Large beginning stocks and the availability of new and more efficient grain export routes established through the Black Sea Grain Initiative (BSGI) in July 2022 (compared to the export routes available in the second half of the 2021/2022 marketing year) allowed Ukraine to export 17 million metric tons of wheat and 28 million metric tons of corn in the 2022/2023 marketing year, a 5% decline in exports of wheat but a 9% increase in exports of corn compared to pre-war levels (USDA WASDE, Sep 2023).

As the country has adapted to the new realities of living under the war and the availability of more sustainable export routes through the BSGI in spring of 2023, Ukrainian farmers did not cut planted acres as severely as anticipated for 2023. Even though area planted was reduced by another 3.7 million acres, excellent yields due to favorable weather conditions are projected to result in 28 million metric tons of corn and 22.5 million metric tons of wheat, placing this year’s production at 17-19% below the pre-war levels.

Based on the last World Agricultural Supply and Demand Estimates (WASDE-USDA) report (Sep 2023), Ukraine’s exports of corn and wheat in the 2023/2024 marketing year are projected to decline 24% and 39%, respectively, compared with pre-war levels. Such a significant downgrade in export projections is explained by the loss of export routes since July of 2023 when Russia pulled out of the BGSI. A follow-up article will examine the new export routes for Ukrainian grain and the possible scenarios for the future of production and exports from Ukraine.

Summary

The war has negatively impacted the overall economy in Ukraine since the beginning of the conflict in February 2022. Ukraine’s corn and wheat production in 2022 declined by 20–23% compared to pre-war levels. Despite very pessimistic projections for grain exports for Ukraine after the invasion, exports have been much stronger than expected. The resilience in Ukrainian grain exports has been achieved through close collaboration between farmers, transportation networks, governments, and foreign allies, but significant challenges remain.

Note

[1] The Black Sea ports were blockaded from February 2022 until July 2022 when the Black Sea Grain Initiative was put in place giving Ukraine 12 months of access to the Black Sea grain exports routes until July 2023 when Russia pulled out of the deal and resumed the blockade.

Tetteh, I., J. Colussi and N. Paulson. “The Second Harvest Under Missiles: Update on the Situation in Ukraine.” farmdoc daily (13):186, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 11, 2023.Permalink

Mitch Miller, CEO of Carbon Green Bioenergy LLC, believes more ethanol producers should start selling the fuel they produce directly to consumers.

“I really believe, as leaders in the industry, we have to complete the supply chain,” he says. “There’re many ways to do that, but the way you best learn about the supply chain is actually being in it yourself. I’ve learned much more about how the system works, how the margin works, how the supply chain works, and how I can best fulfil the needs of that supply chain to actually break the blend wall, by actually being in it myself. Part of this is just, I needed to learn about this because it’s way better than secondhand information.”

The 50 MMgy ethanol plant located in Lake Odessa, Michigan, sells E85 and other blends at a blender pump located on the ethanol plant grounds. But the company’s newest venture into the retail world is to own and operate two of its own convenience store locations, where it will offer Michigan drivers ethanol blended fuel as well as the snacks and drinks typically sold at C-stores.

Matt Lee, manager of the NuVu Fuels C-store, left, and Mitch Miller, CEO of Carbon Green Bioenergy LLC, stand in front of the gas station, which is expected to open for business in September. PHOTO: GREEN FROG PHOTO

As was written about in Ethanol Producer Magazine previously, Carbon Green is also part of a small group of ethanol producers that sells E85 directly to area retailers. Carbon Green calls that its Yellow Hose Program, which supplies more than 30 area gas retailers with E85. Direct sales to the consumer are, however, a related but slightly different project Carbon Green took on about the same time. It’s all part of the company’s strategic diversification plan, Miller says.

EPM talked to several ethanol producers selling direct to consumers in Michigan, Nebraska, Indiana, Wisconsin and Minnesota. While there are others, so far, only a percentage of the industry is in the direct-sales business, whether to gas retailers or consumers. So what’s holding them back? “As producers, we are constantly focusing on inside our walls, and there are opportunities outside our walls,” Miller says, adding that, while it’s a step he believes is worth taking, it does take a leap for ethanol producers to go into other markets.

The E-store

In late July, a newly constructed C-store and gas station was set to open for business in Ionia, Michigan, in September, just seven miles from Carbon Green, Miller says. Branded NuVu Fuels, it will offer drivers E10, E15, E25, E85 and, possibly, E50, Miller said. Gasoline supplier Petersen Oil and Propane is a partner with NuVu Fuels Retail. The ethanol will come from Carbon Green, through its Yellow Hose program.

At about the same time, the company hopes to close on the acquisition of an existing gas station in the Grand Rapids, Michigan, area, he adds. The acquisition was pending in late July. The goal is to reopen that gas station, which will be rebranded as NuVu Fuels as well, by Memorial Day 2016.

There are multiple motivating factors behind what the company is doing, Miller says. First, the goal is to “do our part to take down the blend wall” by increasing consumers’ access to higher-level ethanol blends. Secondly, it’s about educating consumers about the benefits of ethanol. Finally, it’s about promoting a homegrown, domestically produced fuel. “I’ve been in the ethanol industry over 20 years and our main goal has always been to do our part to contribute to energy independence,” he says.

Another example of the direct-sales model was put into place in 2013 by a diversified agribusiness and transportation company. Family-owned Zeeland Farm Services made the leap to selling ethanol blends direct to drivers when the company built a 24-hour travel center across the street from Nebraska Corn Processing ethanol plant, in Cambridge, Nebraska, says Beth Westemeyer, director of Anew Business Development. The 44 MMgy plant is a subsidiary of Zeeland Farm Services, which restarted the idled facility in spring 2010. Ethanol blends sold at Anew Travel Center, including E10, E15, E30 and E85, are blended from ethanol produced across the street.

The close proximity of the two businesses has been mutually beneficial. “We are able to save in many areas and work together to benefit both the plant and the fuel stop,” she said. “Savings on transportation, as well as a direct supply of ethanol, are two large advantages.”

The company considers the venture a great success. “Consumers have taken well to the new business plan of selling ethanol blends as opposed to regular, midgrade, and premium,” she says. “As we have continued to educate the consumer on these blends, we have seen an increase in our higher blends. Our E10 and our E85 are the highest sellers, but we are seeing an increase in E15 as well. Learn more here about our sustainable business practices and the positive impact of ethanol blends on our communities.”

But that’s not the only location where Zeeland Farm Services sells ethanol blends. The company purchases E85 through Carbon Green’s Yellow Hose program and sells it at a fuel dispenser at its headquarters in Zeeland, Michigan. Part of the motivation for both these projects is to educate consumers about ethanol and its benefits. Another aim is to increase market access to the fuel.

“After becoming involved in the ethanol industry, we realized that consumers did not have adequate access to the ethanol blends, and when they did, the ethanol products were not priced correctly,” she says. “We felt that if we could give the consumer access to these products at the fair market price, consumers would realize the benefits of these products and begin to use them more regularly. So far, we have seen this to be true.”

Another company that owns an ethanol plant and also owns retail gas stations is United Cooperative. Like Zeeland Farm Services, United Cooperative is a diversified agribusiness company with its fingers in multiple pies, including owning feed mills, grain elevators, a restaurant and more. Based in Wisconsin, United Cooperative also owns and operates United Ethanol LLC, a 40 MMgy ethanol plant located in Milton, Wisconsin, and owns more than 10 Cenex gas stations. Although EPM was unable to confirm the exact number of gas stations or whether all of the stations utilize blender pumps, the company’s website revealed a promotion for 85-cent E85 at seven of the gas stations on dates in June and July.

On-site Dispenser

Carbon Green’s first step into retail came about two and a half years ago, when it installed an unmanned blender pump on the facility’s grounds, after requests from employees, area farmers and others. The pumps are open for business 24 hours a day to credit card users. There was nowhere to buy E85 and other higher ethanol blends in that area and the requests were coming in daily, Miller says.

Although the thought was that only a few hundred gallons would be sold a day, the reality is that Carbon Green sells about 1,000 gallons a day, and, in mid-July had sold nearly 550,000 gallons in all. The project had a quicker-than-expected, two-year payback period. Also in July, the company eliminated E10 and replaced it with E15.

For ethanol producers already selling E85 direct to area gas retailers, like Carbon Green, putting in an on-site blender pump might not make sense.

However, in the situation where E85 is sold in the area, but it isn’t being priced properly, such as was the case at NuVu Fuels managed Iroquois Bio-Energy Co. LLC, selling ethanol blends at the ethanol plant can help correct the market, Miller says. Iroquois Bio-Energy, a 40 MMgy ethanol plant located in Rensselaer, Indiana, was installed this spring and offers E10, E15, E30 and E85. According to an April press release, initial fuel sales were more than 75 percent E85, and E30 was in the second most-popular category.

In the ever-evolving world of fashion, choosing the right fit for your clothing is crucial. The decision between straight fit and slim fit depends on various factors, including body shape, personal style, and the occasion. Understanding these distinctions allows individuals to make informed choices that align with their preferences and create a stylish and confident appearance. Whether opting for the classic and roomier straight fit or the more tailored and modern slim fit, individuals can express their unique fashion sense while staying comfortable and fashionable

Badger State Ethanol LLC installed two unmanned blender pumps, one on-site at its 55 MMgy facility in Monroe, Wisconsin, and another in nearby Platteville, Wisconsin, about an hour away. “The purpose was to educate our communities about ethanol blends by letting them use them and see the financial benefits and performance for themselves,” says Erik Huschitt, general manager. “To that point it has been extremely successful. Since all of our blends are ethanol blends, we are very excited to give the community an opportunity to buy local, made local. People in the Midwest are loyal and get that.”

Corn Plus Co-Op & LLLP in Winnebago, Minnesota, has had on-site unmanned fuel dispensers for more than a decade. The company sells E10, E15, E20, E30, E40 and E85 from four blender pumps. Education was the main reason the company imitated the project. “We want to get folks to use higher blends,” says Rick Serie, general manager.

Author: Holly Jessen

Managing Editor, Ethanol Producer Magazine

701-738-4946

hjessen@bbiinternational.com

Mitch Miller, CEO of Carbon Green Bioenergy LLC, believes more ethanol producers should start selling the fuel they produce directly to consumers.

“I really believe, as leaders in the industry, we have to complete the supply chain,” he says. “There’re many ways to do that, but the way you best learn about the supply chain is actually being in it yourself. I’ve learned much more about how the system works, how the margin works, how the supply chain works, and how I can best fulfil the needs of that supply chain to actually break the blend wall, by actually being in it myself. Part of this is just, I needed to learn about this because it’s way better than secondhand information.”

The 50 MMgy ethanol plant located in Lake Odessa, Michigan, sells E85 and other blends at a blender pump located on the ethanol plant grounds. But the company’s newest venture into the retail world is to own and operate two of its own convenience store locations, where it will offer Michigan drivers ethanol blended fuel as well as the snacks and drinks typically sold at C-stores.

Matt Lee, manager of the NuVu Fuels C-store, left, and Mitch Miller, CEO of Carbon Green Bioenergy LLC, stand in front of the gas station, which is expected to open for business in September. PHOTO: GREEN FROG PHOTO

As was written about in Ethanol Producer Magazine previously, Carbon Green is also part of a small group of ethanol producers that sells E85 directly to area retailers. Carbon Green calls that its Yellow Hose Program, which supplies more than 30 area gas retailers with E85. Direct sales to the consumer are, however, a related but slightly different project Carbon Green took on about the same time. It’s all part of the company’s strategic diversification plan, Miller says.

EPM talked to several ethanol producers selling direct to consumers in Michigan, Nebraska, Indiana, Wisconsin and Minnesota. While there are others, so far, only a small percentage of the industry is in the direct-sales business, whether to gas retailers or consumers. So what’s holding them back? “As producers, we are constantly focusing on inside our walls, and there are opportunities outside our walls,” Miller says, adding that, while it’s a step he believes is worth taking, it does take a leap for ethanol producers to go into other markets.

The E-store

In late July, a newly constructed C-store and gas station was set to open for business in Ionia, Michigan, in September, just seven miles from Carbon Green, Miller says. Branded NuVu Fuels, it will offer drivers E10, E15, E25, E85 and, possibly, E50, Miller said. Gasoline supplier Petersen Oil and Propane is a partner with NuVu Fuels Retail. The ethanol will come from Carbon Green, through its Yellow Hose program.

At about the same time, the company hopes to close on the acquisition of an existing gas station in the Grand Rapids, Michigan, area, he adds. The acquisition was pending in late July. The goal is to reopen that gas station, which will be rebranded as NuVu Fuels as well, by Memorial Day 2016.

There are multiple motivating factors behind what the company is doing, Miller says. First, the goal is to “do our part to take down the blend wall” by increasing consumers’ access to higher-level ethanol blends. Secondly, it’s about educating consumers about the benefits of ethanol. Finally, it’s about promoting a homegrown, domestically produced fuel. “I’ve been in the ethanol industry over 20 years and our main goal has always been to do our part to contribute to energy independence,” he says.

Another example of the direct-sales model was put into place in 2013 by a diversified agribusiness and transportation company. Family-owned Zeeland Farm Services made the leap to selling ethanol blends direct to drivers when the company built a 24-hour travel center across the street from Nebraska Corn Processing ethanol plant, in Cambridge, Nebraska, says Beth Westemeyer, director of Anew Business Development. The 44 MMgy plant is a subsidiary of Zeeland Farm Services, which restarted the idled facility in spring 2010. Ethanol blends sold at Anew Travel Center, including E10, E15, E30 and E85, are blended from ethanol produced across the street.

The close proximity of the two businesses has been mutually beneficial. “We are able to save in many areas and work together to benefit both the plant and the fuel stop,” she said. “Savings on transportation, as well as a direct supply of ethanol, are two large advantages.”

The company considers the venture a great success. “Consumers have taken well to the new business plan of selling ethanol blends as opposed to regular, midgrade and premium,” she says. “As we have continued to educate the consumer on these blends, we have seen an increase in our higher blends. Our E10 and our E85 are the highest sellers, but we are seeing an increase in E15 as well.”

But that’s not the only location where Zeeland Farm Services sells ethanol blends. The company purchases E85 through Carbon Green’s Yellow Hose program and sells it at a fuel dispenser at its headquarters in Zeeland, Michigan. Part of the motivation for both these projects is to educate consumers about ethanol and its benefits. Another aim is to increase market access to the fuel.

“After becoming involved in the ethanol industry, we realized that consumers did not have adequate access to the ethanol blends, and when they did, the ethanol products were not priced correctly,” she says. “We felt that if we could give the consumer access to these products at the fair market price, consumers would realize the benefits of these products and begin to use them more regularly. So far, we have seen this to be true.”

Another company that owns an ethanol plant and also owns retail gas stations is United Cooperative. Like Zeeland Farm Services, United Cooperative is a diversified agribusiness company with its fingers in multiple pies, including owning feed mills, grain elevators, a restaurant and more. Based in Wisconsin, United Cooperative also owns and operates United Ethanol LLC, a 40 MMgy ethanol plant located in Milton, Wisconsin, and owns more than 10 Cenex gas stations. Although EPM was unable to confirm the exact number of gas stations or whether all of the stations utilize blender pumps, the company’s website revealed a promotion for 85-cent E85 at seven of the gas stations on dates in June and July.

On-site Dispenser

Carbon Green’s first step into retail came about two and a half years ago, when it installed an unmanned blender pump on the facility’s grounds, after requests from employees, area farmers and others. The pumps are open for business 24 hours a day to credit card users. There was nowhere to buy E85 and other higher ethanol blends in that area and the requests were coming in daily, Miller says.

Although the thought was that only a few hundred gallons would be sold a day, the reality is that Carbon Green sells about 1,000 gallons a day, and, in mid-July had sold nearly 550,000 gallons in all. The project had a quicker-than-expected, two-year payback period. Also in July, the company eliminated E10 and replaced it with E15.

For ethanol producers already selling E85 direct to area gas retailers, like Carbon Green, putting in an on-site blender pump might not make sense.

However, in the situation where E85 is sold in the area, but it isn’t being priced properly, such as was the case at NuVu Fuels managed Iroquois Bio-Energy Co. LLC, selling ethanol blends at the ethanol plant can help correct the market, Miller says. Iroquois Bio-Energy, a 40 MMgy ethanol plant located in Rensselaer, Indiana, was installed this spring and offers E10, E15, E30 and E85. According to an April press release, initial fuel sales were more than 75 percent E85, and E30 was in the second most-popular category.

Badger State Ethanol LLC installed two unmanned blender pumps, one on-site at its 55 MMgy facility in Monroe, Wisconsin, and another in nearby Platteville, Wisconsin, about an hour away. “The purpose was to educate our communities about ethanol blends by letting them use them and see the financial benefits and performance for themselves,” says Erik Huschitt, general manager. “To that point it has been extremely successful. Since all of our blends are ethanol blends, we are very excited to give the community an opportunity to buy local, made local. People in the Midwest are loyal and get that.”

Corn Plus Co-Op & LLLP in Winnebago, Minnesota, has had on-site unmanned fuel dispensers for more than a decade. The company sells E10, E15, E20, E30, E40 and E85 from four blender pumps. Education was the main reason the company imitated the project. “We want to get folks to use higher blends,” says Rick Serie, general manager.

Author: Holly Jessen

Managing Editor, Ethanol Producer Magazine

701-738-4946

hjessen@bbiinternational.com